Is Gracex really reshaping the trading experience, or is it just another flashy broker with empty promises? With a growing user base, industry recognition, and bold claims about trading conditions, Gracex Reviews 2025 demand a closer, objective look. In this article, we’ll walk through user journeys, assess accounts and fees, and give you a breakdown based on actual performance, not marketing slogans.

The Platform Experience: MetaTrader 5 at Full Capacity

Gracex leverages MetaTrader 5 across all access points — WebTrader, Android/iOS apps, and desktop software. This ensures a smooth, professional environment for any trading style: scalping, algorithmic, or manual. The platform supports trading bots, technical indicators, and multi-chart analysis. Execution is STP (straight-through processing) with no dealing desk, which means no artificial delays or price manipulation.

Execution quality remains one of the strongest arguments in favor of this broker — something frequently mentioned in Gracex Reviews 2025 from experienced users.

Account Options: A Model for Every Trader Type

The FREE account (max $500 balance) is geared toward beginners — no monthly fee, standard spreads, and access to full platform functionality.

The ZERO account targets high-frequency or active traders with spreads from 0.0 pips, zero commissions, and a flat $100/month subscription. It’s ideal for scalpers or EA users where even fractional savings matter.

The FIX account suits those who prefer fixed cost predictability — spreads start from 3 points, which is reasonable for news traders who need stability.

Lastly, the CENT account enables low-risk strategy testing and micro-trading with just $10 per lot — perfect for automation testing or phased scaling.

Micro-calculation: For 1 standard lot (100,000 notional), average trading costs:

- FREE: ~1.5 pips = $15

- ZERO: ~0 pips + $100/month — cheaper for 10+ trades/day

- FIX: 3 pips = $30

- CENT: $10/lot = flat $10

Across all tiers, the logic is clear — Gracex adapts to usage frequency, budget, and strategy. This tiered system is a frequent highlight in Gracex Reviews 2025 by traders of varying levels.

Real-World Trading Conditions: Spread, Swaps, Execution

Spreads start at 0.0 pips (ZERO account), with no commissions and zero swaps on overnight positions. Combined with STP execution and no dealing desk, traders enjoy fast order routing directly to liquidity providers. This matters most during volatile sessions where delays can cost real money.

In testing, order execution was completed within 100–250ms — matching top-tier ECN brokers. Traders confirm this in forums and review aggregators, especially when comparing performance across sessions like London open or NFP releases.

Execution quality and fee transparency remain key reasons why many positive Gracex Reviews 2025 appear on Trustpilot and forex forums.

Trading Assets: From Majors to Regionals

Gracex supports over 300 instruments across:

- Forex: majors, minors, exotics

- Indices: S&P 500, DAX, Nikkei, FTSE

- Metals: gold, silver, platinum

- Energy: oil, natural gas

- Crypto: BTC, ETH, LTC, XRP

- CFDs: U.S., Europe, Asia, and Russia-focused baskets

This global exposure is praised in Gracex Reviews 2025 as a way to diversify or hedge within one terminal, with competitive leverage and low latency.

Value-Added Features: Beyond Just Trading

Gracex is more than just execution. It offers:

- Social Copy Trading: follow top strategies in a few clicks

- PAMM Accounts: passive income via professional managers

- Bonuses: welcome offers to extend equity

- Analytics and Education: structured by skill level with automation examples

These extras reduce the learning curve and offer monetization paths beyond DIY trading. For many new clients leaving legacy brokers, these tools are a big plus and are often cited in Gracex Reviews 2025 as core reasons for switching.

Regulation and Safety: What’s Behind the Brand

Gracex operates under GRACEXFX Ltd, licensed by the Union of Comoros (Anjouan), License No. L15817/GL. It enforces KYC/AML standards and uses segregated accounts to protect client funds. Though not EU-regulated, it follows international compliance norms similar to other offshore brokers with reputable practices.

In the context of Gracex Reviews 2025, traders view this setup as acceptable, especially considering the broker’s transparency and account security mechanisms.

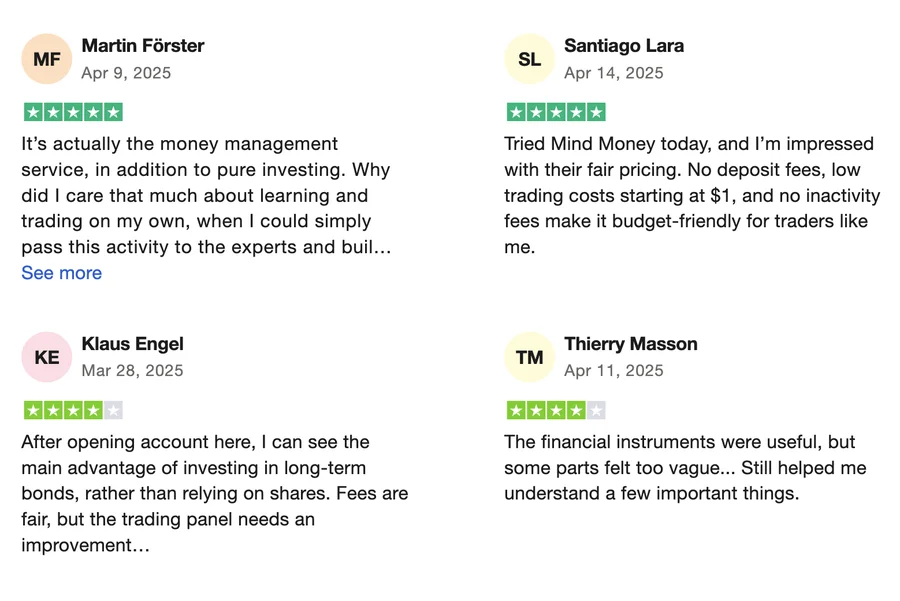

Industry Recognition and Real Feedback

In 2024, Gracex was named:

- The Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

These accolades align with increasing trust signals seen in user feedback. Recurring positives include responsive support, fair fees, and solid uptime. Criticisms mainly concern regional limitations (e.g., not available in some regulated markets), and the $100 monthly fee for ZERO tier — which is only justified for active users.

Still, most Gracex Reviews 2025 confirm consistent execution, flexibility, and value delivery — especially when measured against traditional brokers with wider spreads and slower support.

Final Verdict: Does Gracex Live Up to the Hype?

Yes — but with caveats. Gracex delivers on its core promise of transparent, low-cost trading in a flexible, user-friendly environment. Account choices cater to specific trader profiles, and execution speed rivals top-tier names. While it lacks EU-level regulation, operational quality and client support still place it above many offshore peers.

So, in answering the question posed by the title — Gracex Reviews 2025 do reflect a broker that meets expectations, provided you match your trading style to the right account type and understand the operational framework.