Gracexfx makes bold claims — 0.00 pip spreads, 0% commissions, no swaps, instant access to global markets — but how does it hold up in reality? In this 2025 review, we examine the full trading experience, highlighting what works, what doesn’t, and whether this broker lives up to the hype.

Promise vs. Reality: Are Gracex Reviews 2025 Justified?

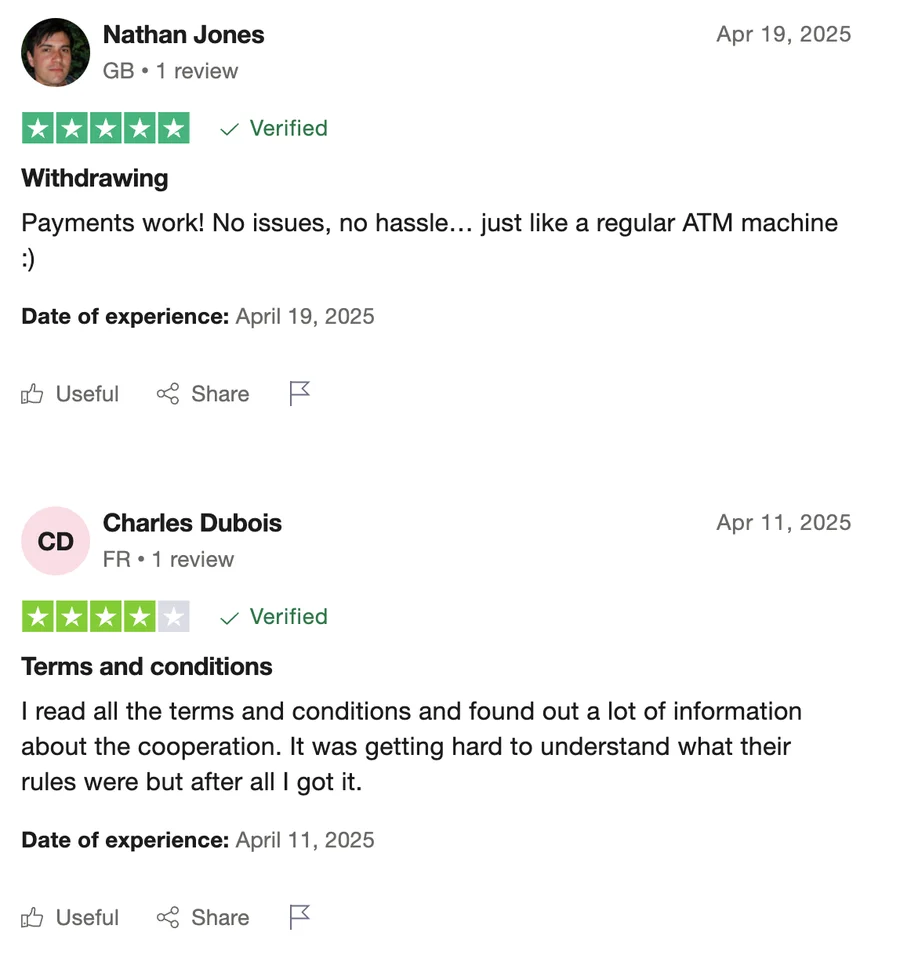

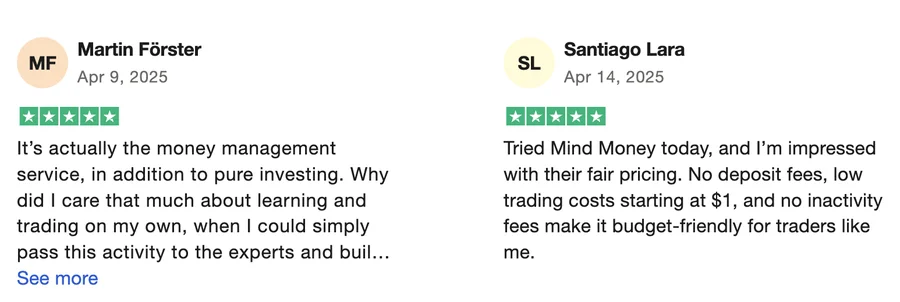

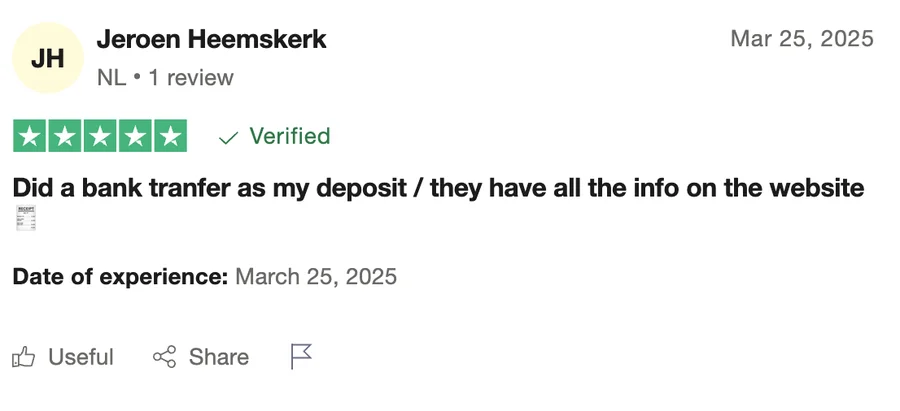

Across forums, broker aggregators, and user feedback platforms, Gracex Reviews 2025 are largely positive. The broker’s no-dealing-desk model, tight spreads, and automation tools attract both beginners and algorithmic traders. But does it serve every profile equally well?

Review sources include Trustpilot, BrokerChooser, and direct trader forums like ForexFactory. Recurring strengths include low-cost execution, responsive support, and copy trading tools. Common weaknesses mention geographic restrictions (e.g., no service to U.S. or EU clients), and relatively high entry thresholds on the ZERO and FIX accounts.

This real-world feedback mirrors the platform’s core promise — efficient, tech-based trading without hidden fees. But for full clarity, let’s break down key areas below.

Low Trading Costs: Where Gracex Really Shines

Gracex operates on a pure STP (Straight Through Processing) infrastructure with no dealing desk interference. This ensures order transparency and removes conflict of interest. The broker’s standout metric is the spread from 0.00 pips, combined with 0% commission and zero swap charges.

Example: a EUR/USD trade with a 0.00 spread and zero commission effectively eliminates all visible execution costs. This all-in cost model is especially favorable for scalpers and high-frequency traders.

Verdict on trading conditions? Extremely competitive — a core reason why Gracex Reviews 2025 are mostly positive.

Account Types and Entry Barriers

- FREE: Entry-level, up to $500 balance, great for beginners or testing the system.

- CENT: $10/lot flat cost, tailored for micro-lot strategies or high-volume grid systems.

- FIX: Fixed spread from 3 pips — ideal for EAs requiring spread predictability.

- ZERO: Professional-tier with ultra-tight spreads, $100/month service fee.

This mix allows traders to grow without switching platforms. However, the $100/month fee for ZERO may be high for smaller accounts.

As part of our Gracex Reviews 2025 focus, this account variety is a net positive — with cost/benefit trade-offs per tier.

MetaTrader 5 + Automation: Power Tools Included

Gracex runs on the full MetaTrader 5 suite, including:

- WebTrader: Lightweight and browser-based.

- Mobile apps: For Android and iOS — support trading-on-the-go.

- Desktop version: Advanced charting, Expert Advisors (EAs), and strategy testing built-in.

Support for algorithmic trading, custom indicators, and multi-asset portfolio management is included. For 2025, Gracex continues to prioritize speed, automation, and trader control — all of which elevate its technical credibility.

Platform-wise, Gracex Reviews 2025 show strong favorability for this setup.

Global Assets and Market Coverage

Gracex gives access to:

- Forex — majors, minors, and exotics

- Indices — including S&P500, DAX, Nikkei, and more

- Metals — like gold, silver, and platinum

- Energy — oil, gas, and renewables

- Cryptocurrencies — including Bitcoin, Ethereum, and altcoins

- Geographic CFDs — grouped by Asia, Europe, US, LATAM, and Russia

This wide spectrum enables diversified portfolios within a single account — a major asset for trend followers and hedge strategies.

In terms of instruments, Gracex Reviews 2025 confirm the depth and breadth of offerings as a major advantage.

Extra Services: From Copy Trading to Education

Gracex supports both passive and active engagement models. Traders can:

- Auto-copy top-performing strategies (Copy Trading)

- Follow market sentiment and leaderboards (Social Trading)

- Invest in PAMM portfolios managed by pros

- Access market education, trading signals, and webinars

- Receive structured welcome bonuses for new accounts

This ecosystem suits traders who want to scale at different commitment levels. Whether you’re watching or managing trades, these services simplify access to results.

Across most Gracex Reviews 2025, these service layers are flagged as key benefits for new and time-constrained users.

Security and Compliance

Gracex is regulated by the Union of Comoros (Anjouan), under license L15817/GL. The broker enforces:

- Segregated client funds

- Mandatory KYC/AML compliance

- Regular auditing and operational transparency

Though not a Tier-1 jurisdiction, this structure aligns with industry-standard protection practices. Traders outside the U.S., EU, and sanctioned zones are eligible.

Security-wise, Gracex Reviews 2025 point to adequate safety for global participants.

Awards and Industry Recognition

In 2024, Gracex received two key awards:

- The Fastest Growing Broker — World Financial Award

- The Best Customer Support — Forex Brokers Association

While awards alone don’t guarantee service quality, they validate the broker’s reputation and investment into platform scaling and client relations.

Recognition in 2024 adds weight to the legitimacy found in Gracex Reviews 2025.

Final Verdict: Is It True That Gracex Is Worth It?

Yes — if you value low trading costs, automation, and service depth. The broker’s model suits scalpers, algo traders, and global multi-asset investors. Downsides include account cost barriers for smaller traders and limited regulatory coverage.

Top 6 Pros:

- 0.00 pip spreads + 0% commission

- MT5 with automation tools

- Diverse account types

- Wide asset coverage

- Copy & Social trading ecosystem

- Global access with compliance structure

Top 3 Cons:

- ZERO account requires $100/month fee

- Restricted to non-EU, non-US residents

- License not Tier-1 (but compliant)

Conclusion: For most retail traders and strategy-driven users, Gracex delivers on its 2025 promises. Its cost model, MT5 setup, and auxiliary services make it a worthy option — provided the geographic and account-type conditions align with your goals.