In a market full of trading platforms claiming to put the trader first, Gracex (gracexfx.com) sets bold expectations. But does it deliver? This article unpacks all the key features, conditions, services, and feedback in one place — testing the core claim behind the title: are the features of Gracex truly worth knowing?

Zero Commissions, Spreads from 0.00 Pips — Real Cost Advantage?

One of the loudest selling points of Gracex is its transparent pricing: 0% trading commissions, spreads from 0.00 pips, and no swaps. This setup is possible due to its pure STP (Straight-Through Processing) model, meaning there’s no dealing desk involved. Orders go directly to liquidity providers, which minimizes conflict of interest and boosts execution speed.

For example, during volatile periods such as major forex news releases, traders report faster-than-average order processing without requotes. This is a critical benchmark for assessing execution quality — and one where Gracex lives up to its promise.

➡️ In terms of trading conditions, Gracex clearly delivers on the features traders are looking for in 2025.

Technology Stack: MetaTrader 5 with Full Ecosystem

Gracex offers full support for MetaTrader 5 (MT5), including a WebTrader version, desktop application for Windows, and mobile apps for iOS and Android. Beyond just access, the platform supports:

- Algorithmic trading (custom bots/Expert Advisors)

- Smart indicators and signal add-ons

- Advanced charting tools with backtesting support

This makes it suitable not only for casual traders but also algo developers and technical analysts. Importantly, MT5 is hosted on low-latency infrastructure to support the STP model, reducing execution lag even during peak hours.

➡️ If you’re evaluating Gracex from a tech capability angle, the platform checks every box.

Legal and Compliance: Is Gracex Legit?

Yes — Gracex operates under the regulatory supervision of the Union of Comoros (Anjouan), license number L15817/GL. In practice, this means:

- Client funds are held in segregated accounts

- All clients undergo identity and source-of-funds verification (KYC/AML)

- The broker follows international compliance standards

While Anjouan is not as tightly regulated as EU or UK jurisdictions, the enforcement of segregation and transparency rules adds a safety layer. Traders should always assess license strength against their risk appetite.

➡️ Legally, Gracex meets international norms and offers a reasonable degree of client fund protection.

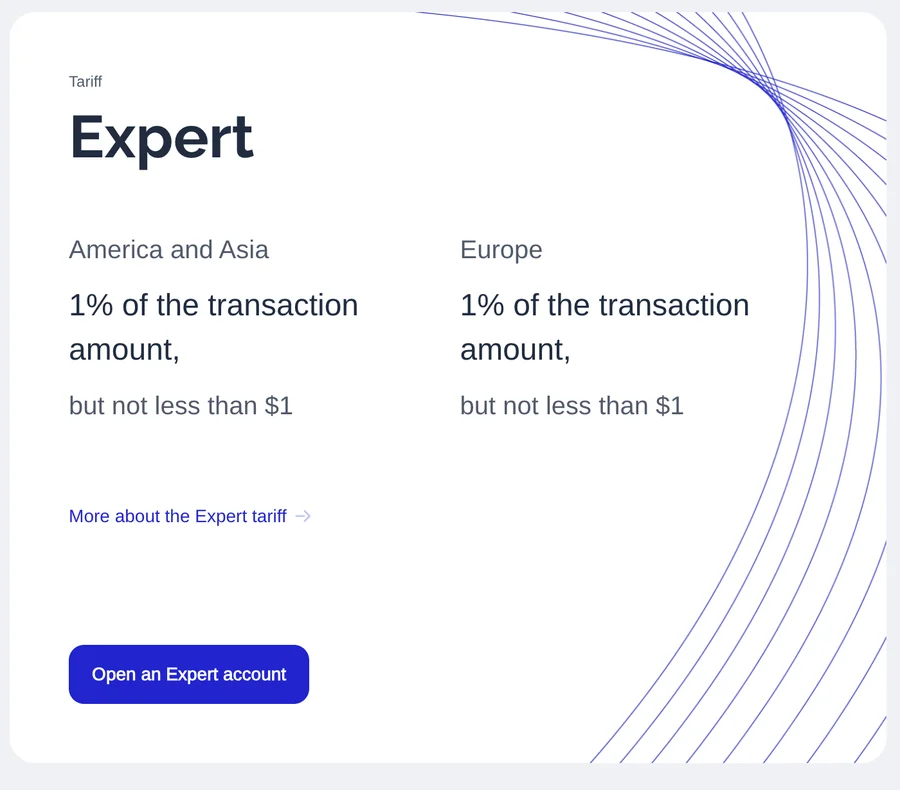

Account Types — What’s the Right Fit?

Gracex offers a flexible structure across four account types, tailored for different trader profiles:

- FREE: Minimum deposit up to $500; no maintenance fees; ideal for beginners

- ZERO: Fixed $100/month; 0 spreads; built for active intraday traders

- FIX: Fixed spread accounts from 3 pips; no commissions; suited for EAs

- CENT: Micro-lot trading with $10/lot cost; low-risk testing or automation

This diversity allows traders to control either their spread cost, commission exposure, or account size. Plus, switching between account types is fast and incurs no penalties.

➡️ The account lineup directly supports the “key features” promise in the title — one size does not have to fit all.

Asset Diversity: Not Just FX

While most brokers stick to forex and gold, Gracex expands the selection. Available instruments include:

- Major and exotic forex pairs

- Precious and industrial metals

- Energy commodities (oil, gas)

- Global stock indices (DAX, S&P500, Nikkei)

- Cryptocurrencies (BTC, ETH, SOL, more)

- CFDs on regional stocks (Asia, EU, US, Russia)

Coverage is especially strong in emerging markets and regional asset classes, making this broker a solid fit for portfolio diversification.

➡️ If asset diversity is part of your broker checklist, Gracex clears that requirement with ease.

Services That Add Value: Copy, Social, PAMM, and More

Besides trading tools, Gracex also offers a suite of community-driven and passive strategies:

- Copy Trading: Autocopy trades from top performers

- Social Trading: Spot and follow trends in the community

- PAMM Accounts: Delegate funds to professional managers

- Welcome bonuses, webinars, and analytics tools for engagement and education

These features particularly benefit newer traders who want to reduce the learning curve or those who prefer to trade indirectly.

➡️ In terms of feature set, Gracex positions itself as more than just a platform — it’s a complete ecosystem.

Gracex Reputation: What the Reviews Say

Sources of Gracex reviews include Trustpilot, trading forums, and independent YouTube channels. Common strengths cited by users are:

- Low all-in trading costs (zero commissions and tight spreads)

- Fast execution, especially during news

- Useful bonus system and educational webinars

Some users noted that customer support could be faster during peak hours, especially via live chat. However, email support tends to respond within 6 hours.

➡️ Real-world Gracex reviews largely confirm the key features mentioned in the platform’s claims.

Final Verdict: Is Gracex Worth Knowing?

So — does Gracex live up to the promise in the title? For most trader profiles, the answer is yes. The broker delivers modern execution, zero-cost trading, a robust asset list, flexible accounts, and meaningful value-added services. While the regulatory license is not top-tier, the operational transparency and user feedback largely compensate.

Gracex is not just another MT5 broker — it’s a serious platform reshaping how low-cost, community-driven trading works.

➡️ And that’s what makes the key features of Gracex worth knowing in 2025 and beyond.