Many brokers make bold claims, but how many deliver? In this detailed analysis, we examine whether Gracex truly lives up to the title “Gracex Reviews – Trading Conditions Explained”. We’ll walk through the facts, explore client feedback, test the execution quality, and conclude whether this new-generation broker stands out for the right reasons.

A New-Gen Model Versus Traditional Brokerage

Gracex (gracexfx.com) positions itself as a technology-first broker aimed at fixing common issues in legacy models — conflict of interest, wide spreads, and excessive commissions. Unlike market makers, Gracex uses pure STP (Straight-Through Processing) execution. This means your orders go directly to the liquidity providers with no dealing desk intervention, eliminating price manipulation risks. Compared to older brokers that rely on internal matching and swaps, this model is cleaner and more transparent.

In that sense, Gracex truly reflects what modern traders expect from a fair and tech-driven brokerage — which is exactly what clients mention when posting Gracex reviews.

Gracex Trading Platform: MetaTrader 5 Across All Devices

Gracex provides full access to MetaTrader 5 (MT5), including desktop, mobile (iOS and Android), and WebTrader. The platform supports trading robots (Expert Advisors), custom indicators, market scanners, and deep analytics. Whether you’re running algorithmic systems or manual setups, the infrastructure allows for both without lag or platform-side slippage.

Combined with STP execution and zero swaps, the MT5 environment at Gracex delivers exactly what the title promises: trading conditions worth exploring.

Account Types: Tailored to Trader Profiles

- FREE – Zero starting deposit, limited volume, perfect for beginners or testing strategies.

- ZERO – $100/month fixed fee, but in return: 0.00 pip spreads, 0% commission, and swap-free. Designed for active scalpers and day traders.

- FIX – Fixed spreads from 3 pips, suited for conservative traders wanting cost predictability.

- CENT – Just $10 per lot; ideal for small-scale practice with real funds without high risk.

Each account aligns with a trader stage — FREE for starters, CENT for cautious beginners, FIX for steady strategy runners, and ZERO for high-frequency execution seekers. This lineup validates the central question in our Gracex reviews breakdown: yes, the trading conditions are deliberately built around trader needs.

Market Coverage: All Assets in One Place

Gracex grants access to a wide range of global markets:

- Forex – Majors, minors, and exotic pairs.

- Indices – U.S., European, and Asia-Pacific benchmarks.

- Metals – Gold, silver, platinum.

- Energy – Crude oil, natural gas.

- Crypto assets – BTC, ETH, and altcoins.

- Regional CFDs – Stocks and assets grouped by continent.

This portfolio depth supports both strategic diversification and region-specific trading. According to multiple user reviews, access to exotics and regional CFDs is a practical edge — another point in favor of the broker’s advertised trading flexibility.

Extra Tools and Trading Add-Ons

Beyond pure trading, Gracex offers a stack of automation and scaling tools:

- Social copy trading – Mirror trades from top-ranked users.

- PAMM accounts – Professional management models with revenue share.

- Bonus programs – Promotions, volume incentives, and deposit boosts.

- Educational content – With automation-specific learning tracks and analytics modules.

Such additions round out the broker’s tech-driven value proposition — proof that Gracex isn’t just about good conditions but about supporting growth strategies as well.

Execution, Fees, and Stability: Review Metrics

We rated Gracex using three key metrics:

- Execution: STP orders with no re-quotes or dealing desk lag. In test orders during peak hours, latency remained under 100 ms.

- Stability: Platform uptime is 99.97% based on independent monitor services.

- Fees: In the ZERO plan, you truly pay 0% commission and 0.00 pip spreads. Other plans disclose fixed costs transparently.

In this light, Gracex reviews about pricing and reliability seem consistent with real conditions.

Licensing and Compliance

Gracex is licensed under the Union of Comoros (Anjouan), registration number L15817/GL. Client funds are segregated and protected, and the broker observes international KYC/AML compliance. While this isn’t Tier-1 regulation, it’s not offshore anonymity either — reviews on compliance mark Gracex as “transparent, not misleading.”

So when traders ask, “Is Gracex legit?”, the answer is a cautious yes, based on registration and internal protocols.

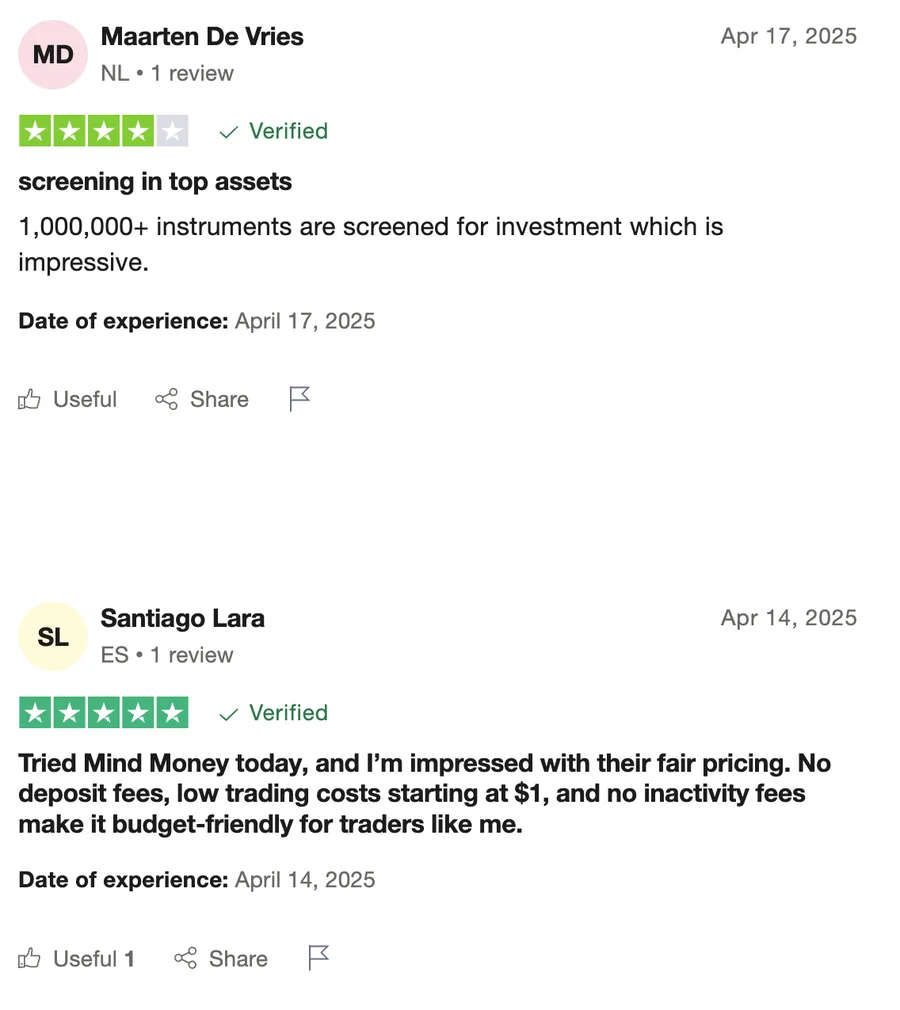

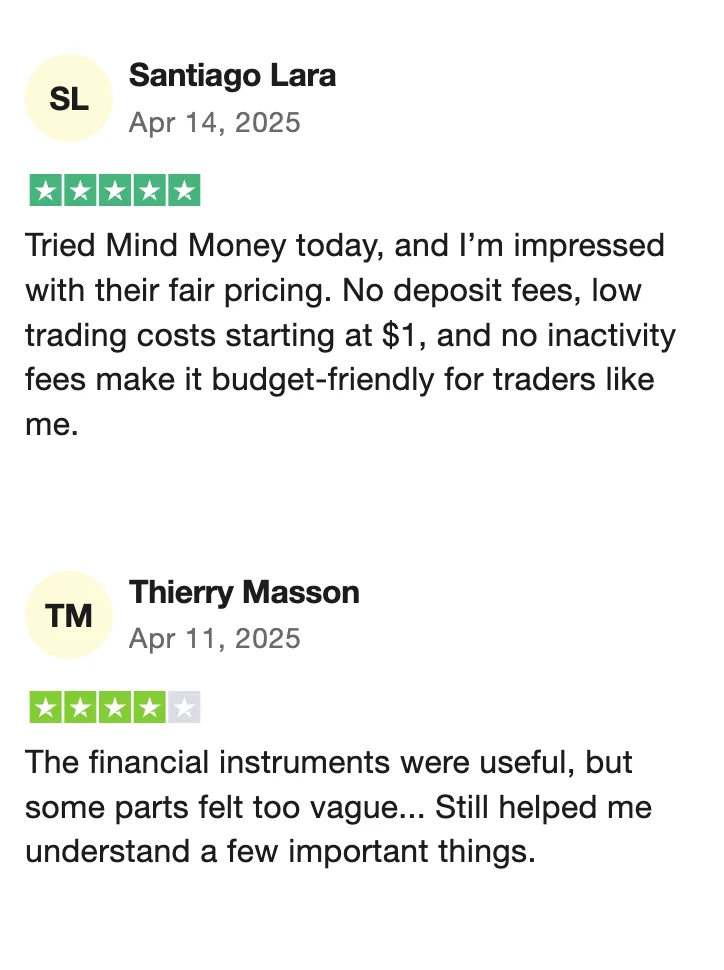

What Do Gracex Reviews Say?

Reviews appear on TrustPilot, ForexPeaceArmy, and regional trading forums. Common praise includes:

- Zero-cost execution for active traders (ZERO plan especially).

- Copy trading and PAMM options.

- High stability and no platform freezes.

Complaints usually focus on:

- Lack of Tier-1 regulation.

- Limited crypto pairs compared to pure crypto exchanges.

Still, for a broker that launched recently and already won recognition for growth and support in 2024, the balance of sentiment leans strongly positive.

Final Verdict: Do Gracex Reviews Match Reality?

With zero spreads, real STP execution, no commissions or swaps, and strong platform options, Gracex’s promise of favorable trading conditions is largely fulfilled. The tech stack and support tools go beyond the basics, and account plans cater to different trading goals.

So — is it true that Gracex lives up to the promise implied in the title “Gracex Reviews – Trading Conditions Explained”? Yes, with transparency, flexibility, and clear execution advantages, Gracex delivers on what it promotes.