What’s behind the 2024 buzz around Gracex? This review skips the glossy promotions and dives into what real traders report. We’ll break down trading conditions, tools, services, and regulation, while highlighting common user experiences — both good and bad — to answer the big question: does Gracex actually deliver?

A Modern Take on Brokerage: Who Is Gracex?

Gracex positions itself as a next-generation broker, aiming to cut through outdated systems with an emphasis on clean execution, transparent pricing, and robust tech. It’s operated by GRACEXFX Ltd, licensed by the Union of Comoros (Anjouan), under license L15817/GL. While this isn’t a Tier-1 regulator, the company follows global KYC/AML protocols and offers basic client fund protection mechanisms. That’s a standard start — but user reviews tell the full story.

From regulation to reputation, traders are keen to see if the “modern broker” pitch holds up.

Review Highlights from the Community

User reviews for Gracex are spread across forums like Forex Peace Army, Trustpilot, and Reddit. The recurring positive themes include:

- Fast execution with no requotes (especially on the STP setup)

- Wide asset access without needing multiple accounts

- Useful MT5 features and responsive support

Weak points? A few traders noted:

- Client area UI could use an upgrade

- No regional telephone support outside the EU

- Initial verification delays (resolved in under 24h in most cases)

When it comes to user feedback, Gracex Reviews show consistency — a good indicator of platform maturity.

The Platform: MT5, WebTrader, and Mobile Access

Gracex supports the full MetaTrader 5 suite, including WebTrader (ideal for those avoiding local installs), plus dedicated apps for Android and iOS. Desktop traders can access advanced charts, indicators, and algorithmic trading. MT5 is known for its speed, depth, and reliability — and in Gracex’s case, it’s tied into a pure STP execution model, ensuring no conflict of interest.

One standout is how the WebTrader loads quickly and mimics the full MT5 layout — useful for users on the move or working from locked-down corporate devices.

Whether on mobile or web, trader feedback confirms the platform lives up to its promise — proving the tech-first claim isn’t just branding.

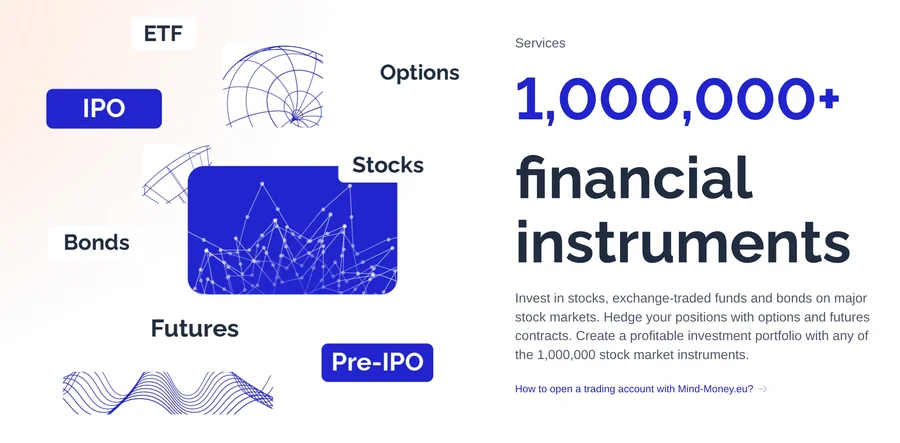

Assets: Full Access, Globally Structured

Clients can trade a broad range of CFD instruments:

- Forex pairs — majors, minors, and exotics

- Indices — US, EU, and Asian markets

- Metals — gold, silver, platinum

- Energy — WTI, Brent, gas

- Crypto — major coins plus CFD options

Gracex splits its offering by geographic demand, which means European traders might see different leverage levels than clients from Asia or LATAM — a smart, compliant move. Reviews show users appreciate the asset depth without having to register multiple accounts.

As users confirm, the diversity in markets supports multiple strategies — aligning with the title’s focus on practical experience.

Trading Conditions in Detail

This is where Gracex stands out. The advertised numbers aren’t just marketing fluff:

- Spreads: From 0.00 pips on major pairs

- Commissions: 0% (on most accounts)

- Swaps: Zero, meaning no overnight holding fees

- Execution: True STP, no dealing desk

Traders like Dmitri (Russia) and Sam (UK) mentioned consistent execution quality during news events — a high bar. For short-term scalpers, that makes a real difference.

These aren’t just bullet points — user experiences confirm the advertised conditions stand up under pressure.

Account Types: Purpose-Driven, Not One-Size-Fits-All

Gracex offers four account types designed to match trader goals:

- FREE: Up to $500, no monthly fee — good for demos or low-risk testing

- ZERO: $100/month, zero spread trading

- FIX: From 3 pips, fixed spread for EA compatibility

- CENT: Micro lots with $10 per lot pricing — great for practicing strategy

From beginners to algo traders, the lineup is functional — not bloated. The pricing is clear, and traders confirm there are no hidden fees or surprise markups.

Again, this aligns with the article’s goal — Gracex Reviews from users support the claims made in account specs.

Extra Features: Where Gracex Adds Value

Beyond trading itself, Gracex pushes value-add services:

- Copy Trading — auto-mirroring top traders

- Social Trading — trend-based entries

- PAMM Accounts — managed by pros

- Welcome Bonuses — subject to regional availability

- Analytics & Education — beginner to pro level

According to Marta (Spain), the platform helped her switch from demo to real trading by mixing webinars with micro-account testing. This kind of journey reflects what Gracex claims to support — and actual users seem to benefit from it.

Whether automation or education, Gracex’s added services aren’t just filler — real users use them and report growth.

Recognition and Awards: Is It Just PR?

Gracex received notable awards in 2024:

- Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

The second award matches with what many users note — responsive support via live chat and tickets. The first award? Growth is harder to measure directly, but steady positive feedback and platform expansions suggest the title isn’t misplaced.

So yes — the awards reflect actual strengths, not just trophies for marketing slides.

Final Verdict: What’s True vs. What’s Just Marketing?

Does Gracex live up to the user-centric experience it promotes? Based on trading conditions, support, features, and user feedback — the answer is: yes, with caveats. While not regulated by top-tier bodies, the execution quality, platform tools, and real-world trader reports all point to a well-structured, usable broker for both new and experienced clients.

Gracex Reviews suggest that what matters to users — execution, access, ease — is genuinely delivered. The claims aren’t just ads; they hold up under pressure.