Is the promise of zero spreads and commission-free trading too good to be true? That’s the core of most Gracexfx reviews circulating online. In this article, we dig deep to separate fact from marketing — examining conditions, user experiences, platform reliability, and overall trustworthiness. Here’s what real traders need to know.

Company Snapshot: What Gracexfx Claims to Offer

Gracex positions itself as a next-generation broker focused on transparency, efficiency, and affordability. Operated by GRACEXFX Ltd and licensed under the Union of Comoros (Anjouan) — license number L15817/GL — the firm adheres to international KYC/AML protocols and keeps client funds segregated for added security.

The brokerage has earned notable accolades, including “Fastest Growing Broker 2024” and “Best Customer Support 2024”, reflecting both market traction and user satisfaction. These claims are increasingly echoed in many Gracexfx reviews that highlight responsive support and rapid platform evolution.

As with any broker, impressive headlines must be weighed against practical performance — justifying the scrutiny implied in “Gracexfx Reviews – Pros, Cons, and Real Opinions.”

Trading Platform: MetaTrader 5 in Full Gear

Gracex provides access to the industry-standard MetaTrader 5 — available via desktop, web (WebTrader), and mobile apps for iOS and Android. The platform supports algorithmic strategies, custom indicators, real-time analytics, and automated risk controls. It’s designed for scalability, meaning both beginners and algorithmic traders can work efficiently.

Reviewers frequently note the platform’s reliability and clean execution, reinforcing positive aspects in several Gracexfx reviews.

With MT5’s full ecosystem available, Gracex delivers on the tech promise — a key piece of the title’s puzzle.

Conditions: The “Zero Spread” Equation

Perhaps the most advertised feature is Gracex’s low-cost structure: 0.00 pips spreads, 0% commission, and zero swap fees — a trio that’s especially attractive to scalpers and high-volume traders. Underpinning this is STP (Straight-Through Processing) execution with no dealing desk, removing conflict of interest and improving transparency.

This cost model reduces trading friction substantially, as noted in many performance-focused Gracexfx reviews.

That said, spreads from 0.00 pips are typically reserved for specific account types — which brings us to account segmentation.

Account Types: A Range for Every Profile

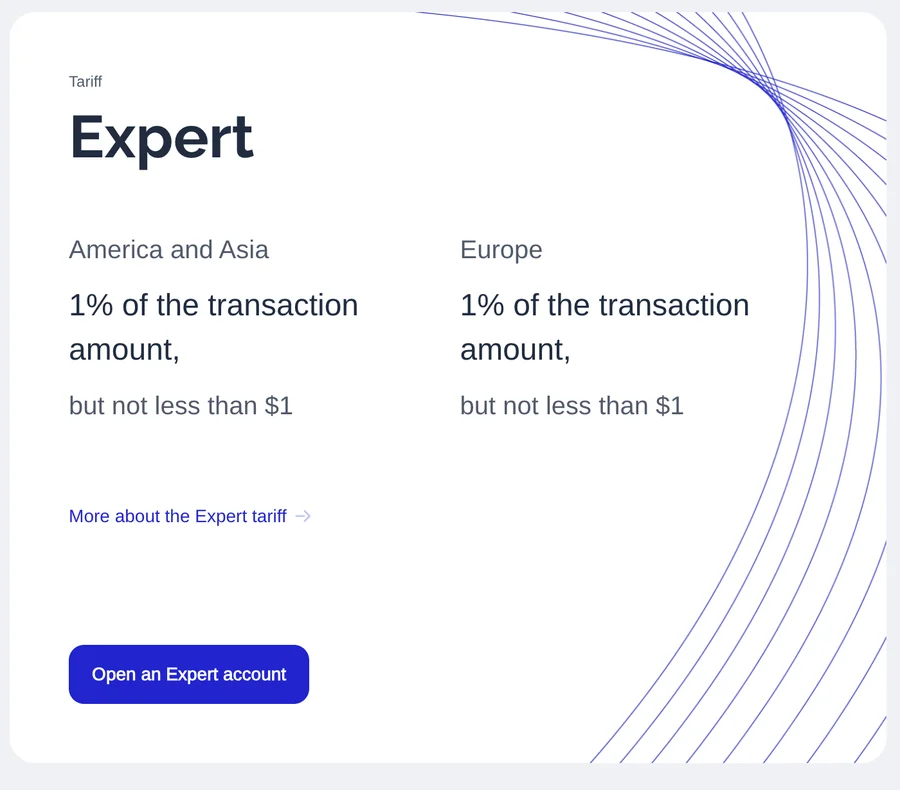

- FREE: No entry cost, up to $500 balance; great for beginners but limited in volume scaling.

- ZERO: $100/month service fee with ultra-low spreads and no commission; ideal for professionals prioritizing execution quality.

- FIX: Fixed spreads from 3 points; designed for traders who prefer predictability over raw speed.

- CENT: $10/lot model aimed at micro-investors and EA testers; low exposure, full platform access.

This segmentation gives Gracex broad appeal — one of the key strengths often cited in Gracexfx reviews across trader forums.

Add‑Ons: More Than Just Trading

Beyond order execution, Gracex enriches the trader journey with Copy Trading (mirror pro trades), Social Trading (community signals), PAMM accounts (capital management by experts), education hubs, and regular market analysis. These features aim to empower traders of all skill levels — from passive income seekers to technical strategists.

Bonus programs and learning content add another layer of user-friendliness — factors that are often rated positively in well-balanced Gracexfx reviews.

Asset Coverage: A Truly Diverse Market Offering

Traders with Gracex can access a wide range of instruments:

- Major & exotic Forex pairs

- Indices from global markets (US, EU, Asia)

- Metals like gold and silver

- Energy commodities (oil, gas)

- Cryptocurrencies (Bitcoin, Ethereum, altcoins)

- CFDs across regional assets (Russia, Europe, Asia, Latin America)

This broad selection means fewer limitations — especially for portfolio diversifiers. Many Gracexfx reviews mark this as a strong competitive edge.

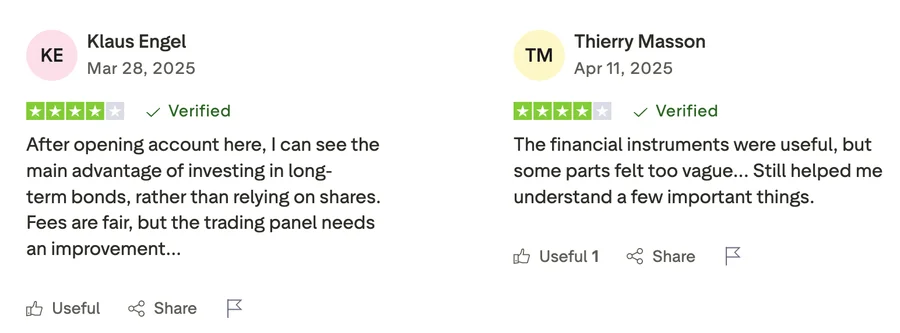

Reputation Breakdown: Real Feedback, Real Results

Based on online feedback from platforms like Trustpilot, trading forums, and YouTube reviews, the recurring positives include:

- Consistently low spreads and minimal slippage

- Responsive multilingual support

- Fast withdrawals (1–2 days for major methods)

- User-focused design and accessible interface

However, a few drawbacks are regularly mentioned:

- License from Comoros — not Tier 1 jurisdiction

- Limited information on ownership transparency

- Bonus terms not clearly explained

This matches the balanced perspective promised in the title — “Gracexfx Reviews – Pros, Cons, and Real Opinions.”

Gracexfx Reviews: Final Verdict — Worth It?

If you’re looking for ultra-low-cost trading with tech-backed execution and optional passive income streams, Gracex delivers. For traders who value Tier 1 regulation and complete company transparency, there may be pause. However, on balance, the broker delivers excellent value — particularly for mid- to high-frequency traders who want streamlined access to multiple markets.

So, is it true that Gracexfx offers what it promises? For the most part — yes, especially when judged by real-world cost-efficiency, platform quality, and growth trajectory.

In conclusion, while not perfect, Gracex proves to be a reliable option for modern traders — just as the title “Gracexfx Reviews – Pros, Cons, and Real Opinions” suggests.